Silvio Gesell

The Natural Economic Order

PREFACE TO THE THIRD EDITION, 1918

PREFACE TO THE FOURTH EDITION, 1920

2. THE RIGHT TO THE WHOLE PROCEEDS OF LABOUR

3. REDUCTION OF THE PROCEEDS OF LABOUR THROUGH RENT ON LAND

4. INFLUENCE OF TRANSPORT COSTS ON RENT AND WAGES

5. INFLUENCE OF SOCIAL CONDITIONS ON RENT AND WAGES

6. MORE PRECISE DEFINITION OF FREELAND

7. FREELAND OF THE THIRD CLASS

8. INFLUENCE OF FREELAND OF THE THIRD CLASS ON RENT AND WAGES

9. INFLUENCE OF TECHNICAL IMPROVEMENTS ON RENT AND WAGES

10. INFLUENCE OF SCIENTIFIC DISCOVERIES ON RENT AND WAGES

11. LEGISLATIVE INTERFERENCE WITH RENT AND WAGES

12. PROTECTIVE-DUTIES, RENT AND WAGES

14. INFLUENCE OF CAPITAL-INTEREST ON RENT AND WAGES

15. SUMMARY OF RESULTS ATTAINED SO FAR

16. RENT OF RAW MATERIALS AND BUIILDING SITES, AND ITS RELATION TO THE GENERAL LAW OF WAGES

17. FIRST GENERAL OUTLINE OF THE LAW OF WAGES

1. THE MEANING OF THE WORD FREE-LAND

4. EFFECTS OF NATIONALISATION OF THE LAND

5. THE CASE FOR NATIONALISATION OF THE LAND

1. HOW THE NATURE OF MONEY IS REVEALED

2. THE INDISPENSABILITY OF MONEY AND THE INDIFFERENCE OF THE PUBLIC TO THE MONEY-MATERIAL

4. WHY MONEY CAN BE MADE OF PAPER

5. THE SAFETY AND COVERING OF PAPER-MONEY

6. WHAT SHOULD THE PRICE OF MONEY BE?

7. HOW THE PRICE OF MONEY CAN BE MEASURED WITH PRECISION

8. WHAT DETERMINES THE PRICE OF PAPER-MONEY?

9. INFLUENCES TO WHICH DEMAND AND SUPPLY ARE SUBJECT

11. THE LAWS OF CIRCULATION OF THE PRESENT FORM OF MONEY

12. ECONOMIC CRISES AND THE CONDITIONS NECESSARY TO PREVENT THEM

14. CRITERION OF THE QUALITY OF MONEY

15. WHY THE CRUDE QUANTITY THEORY FAILS WHEN APPLIED TO MONEY

PART IV. FREE-MONEY, OR MONEY AS IT SHOULD BE

2. HOW THE STATE PUTS FREE-MONEY IN CIRCULATION

4. THE LAWS OF CIRCULATION OF FREE-MONEY

5. HOW FREE-MONEY WILL BE JUDGED

K. The Unemployment Insurance Office

N. The Theorist on Economic Crises

6. THE INTERNATIONAL EXCHANGES

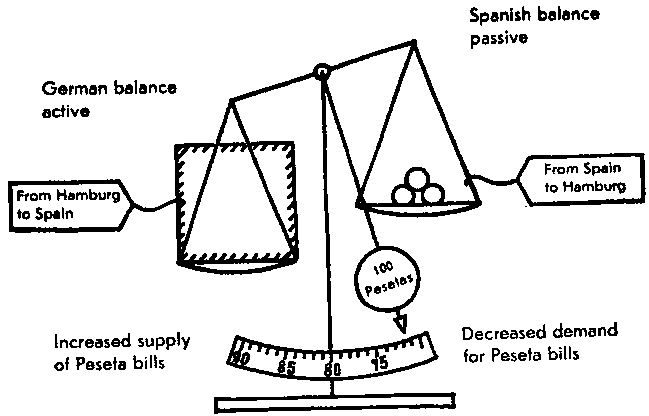

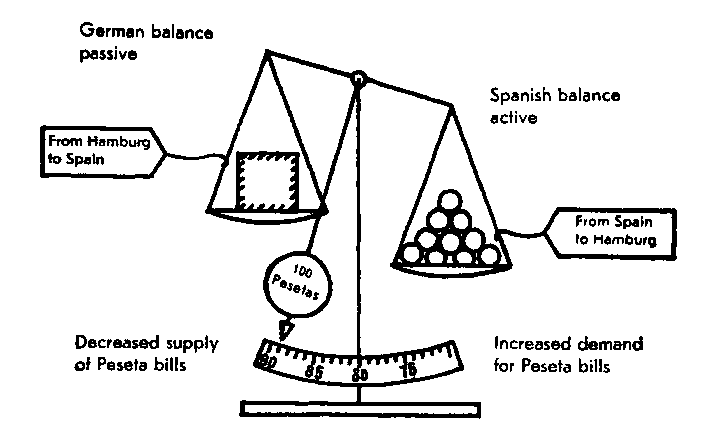

1. The Mechanism of the Exchanges

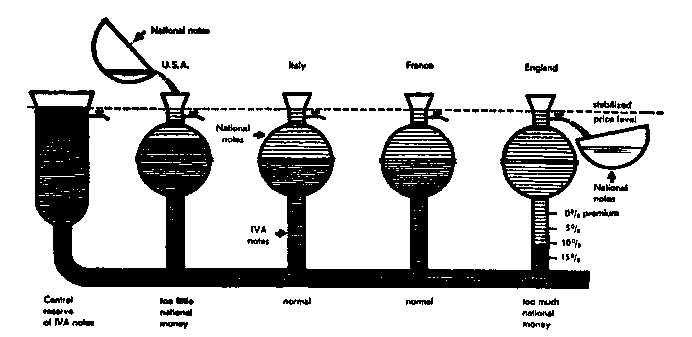

2. Stabilisation of the International Exchanges: Theory.

PART V. THE FREE-MONEY THEORY OF INTEREST

3. TRANSFER OF BASIC INTEREST TO THE WARES

4. TRANSFER OF BASIC INTEREST TO SO-CALLED REAL CAPITAL

5. COMPLETION OF THE FREE-MONEY THEORY OF INTEREST

6. FORMER ATTEMPTS AT EXPLAINING CAPITAL INTEREST

PREFACE TO THE THIRD EDITION, 1918

Magna quies in magna spe.

The economic order here discussed is a natural order only in the sense that it is adapted to the nature of man. It is not an order which arises spontaneously as a natural product. Such an order does not, indeed, exist, for the order which we impose upon ourselves is always an act, an act consciously willed.

The proof that an economic order is suited to the nature of man is furnished by observation of mankind’s development. The economic order under which men thrive is the most natural economic order. Whether an economic order which stands this test is at the same time technically the most efficient order, whether it provides the bureau of trade statistics with record figures is a matter of secondary importance. At the present day it is easy to imagine an economic system of high technical efficiency coupled with gradual exhaustion of the human material. It may, however, be taken for granted that an economic order under which mankind thrives will also prove its technical superiority. For human work can, ultimately, only advance with the advance of the human race. “Man is the measure of all things” including the economic system under which he lives.

The prosperity of mankind, as of all living beings, depends in the main upon whether selection takes place under natural laws. But these laws demand competition. Only through competition, chiefly competition in the economic sphere, is right evolution, eugenesis, possible. Those who wish to ensure the full miraculous effects of the laws of natural selection must base their economic order upon competition under the conditions really decreed by nature, that is, with the weapons furnished by nature after the exclusion of all privileges. Success in competition must be exclusively determined by inborn characteristics, for only so are the causes of the success transmitted to the offspring and added to the common characteristics of mankind. Children must owe their success, not to money, not to paper privileges, but to the ability, strength, love and wisdom of their parents. Only then shall we be justified in hoping that humanity may in time shake off the burden of inferior individuals imposed upon it by thousands of years of unnatural selection — selection vitiated by money and privileges. And we may also hope that in this way supremacy may pass from the hands of the privileged, and that mankind, led by the noblest sons of men, may resume its long-interrupted ascent towards divine aims.

But the economic order which we are about to discuss has another claim to the title of a natural order.

Human beings, to prosper, must be able under all circumstances to give themselves out for what they are. A man must be something, not appear something; he must be able to stride through life with head erect-to speak the truth without incurring the risk Of hardship or injury. Sincerity must not remain the privilege of heroes. The economic order must be so framed that a man may combine sincerity with the highest degree of economic success. The dependence inseparable from economic life should affect things only, not men.

If a man is to be free to act as his nature dictates, religion, custom and law must extend him their protection when, in his economic life, he is guided by justified egoism-when he obeys the impulse of self- preservation given him by nature. If a malls actions conflict with religious opinions, and if the man, nevertheless, is morally thriving, the religious opinions should be examined afresh on the presumption that a tree cannot be evil which bears good fruit. We must avoid the fate of a Christian reduced to beggary and disarmed in the economic trial of strength by the logical application of his creed-with the result that he and his brood go under in the process of natural selection. Humanity gains nothing if the finest individuals it produces are crucified. Eugenic selection requires the direct contrary. The best of mankind must be allowed to develop, for only then can we hope that the inexhaustible treasures latent in man will gradually be brought to light.

The Natural Economic Order must, therefore, be founded upon self-interest. Economic life makes painful demands upon the will, for great natural indolence must be overcome; it requires, therefore, strong impulses, and the only impulse of sufficient strength and constancy is egoism. The economist who calculates and builds upon egoism, calculates correctly and builds for all time. The religious precepts of Christianity must not, therefore, be transferred to economic life, where their only effect is to produce hypocrisy. Spiritual needs arise only when bodily needs have been satisfied, and economic effort should satisfy the bodily needs. It would be preposterous to start work with a prayer or poem. “ The mother of the useful arts is want; the mother of the fine arts is superfluity “ says Schopenhauer. In other words, we beg when hungry and pray when fed.

An economic order thus founded upon egoism is in no way opposed to the higher impulses which preserve the species. On the contrary, it furnishes the opportunities for altruistic actions and the means for performing them. It strengthens the altruistic impulses by making their satisfaction possible. Under the opposite form of economic order everyone would send needy friends to an insurance company and sick relatives to a hospital, the State would make all personal assistance superfluous. With such an order it seems to me that many tender and valuable impulses must be lost.

In the Natural Economic Order founded upon egoism everyone must be assured the full proceeds of his own labour, and must be allowed to dispose of these proceeds as he thinks fit. Anyone who finds satisfaction in sharing his wages, his income, his harvest, with the poor may do so. Nobody requires, but nobody hinders such action. It has been said that the most cruel punishment imaginable is to bring a man among sufferers crying aloud for help which he is unable to give them. To this terrible situation we condemn each other if we build economic life on any other basis than egoism; if we do not allow everyone to dispose as he thinks fit of the proceeds of his labour. To reassure the humanitarian reader we may here remark that public spirit and self-sacrifice best thrive when the economic task is crowned with success. The spirit of sacrifice is one result of the feeling of personal security and power of those who know that they can trust to their own right hands. We may also remark that egoism should not be confused with selfishness. Selfishness is the vice of the short-sighted. Wise men soon recognise that their interest is best served by the prosperity of the whole.

By the Natural Economic Order we mean, therefore, an order in which men compete on equal terms with the equipment given them by nature, an order in which, consequently, the leadership falls to the fittest, an order in which all privileges are abolished, in which the individual, obeying the impulse of egoism, goes straight for his, aim, undisturbed by scruples alien to economic life-scruples which he will have opportunities enough of obeying outside economic life.

One of the conditions of this natural order is fulfilled in our present, much-abused, economic order. The present economic system is founded upon egoism, and its technical achievements, which nobody denies, are a guarantee of the efficiency of the new order. But the other, the most essential condition of any economic order that can be called natural-equal equipment for the economic struggle-remains to be achieved. Purposeful constructive reform must be directed towards suppressing all privileges which could falsify the result of competition. This is the aim of the two fundamental reforms here described: Free-Land and Free-Money.

The Natural Economic Order might also be called the “Manchester System”, the economic order which has been the ideal of all true lovers of freedom-an order standing by itself without intervention from outside, an order in which the free play of economic forces would rectify the blunders of State-Socialism and short-sighted official meddling.

One can, it is true, now speak of the Manchester system only to those whose judgement is unaffected by the mistaken attempts at putting it in practice. Faults of execution are not proofs of the faultiness of the plan itself, yet an acquaintance with what is popularly known as the Manchester system is enough to make most people curse the whole theory from beginning to end.

The Manchester school of economists took the right road, and the subsequent Darwinian additions to their doctrine were also correct. But the first and most important condition of the system was not investigated. There was no inquiry about the field in which the free play of economic forces was to take place. It was assumed, sometimes from dishonest motives, that the conditions of competition in the existing order (including the privileges attached to the private ownership of land and to money) were already sufficiently free, provided that the State stood aside and interfered no further with the development of economic life.

These economists forgot, or did not wish to see, that for a natural development the proletariat must be given the right of reconquering the land with the same weapons by which it was taken from them. Instead of this, the Manchester economists appealed to the State, which by its intervention had already disturbed the free play of economic forces, to prevent, by its power of coercion, the establishment of a really free play of forces. Such an application of the Manchester system was by no means in accordance with its theory. To protect certain privileges, dishonest politicians exploited a theory which rejected all privileges.

To form a just opinion of the original Manchester theory one must not begin by investigating its later applications. The Manchester economists expected from the free play of forces, first, that the rate of interest would gradually sink to zero. This expectation was founded on the fact that in England, where the market was relatively best provided with loan-money, the rate of interest was also lowest. The release of economic forces and their free play, with the resulting increase in the offer of loan-money would eliminate interest and thus cleanse the darkest plague-spot in our present economic system. The Manchester economists did not yet know that certain inherent defects in our m monetary system (which they adopted without examination) were insuperable obstacles to the elimination, in this way, of the privileges of money.

Again the Manchester theory asserted that the division of inheritances and the natural economic inferiority of children bred in opulence would divide landed property and automatically bring rents into the possession of the people as a whole. This belief may seem to us to-day ill-grounded, but it was at least justified to this extent, that rents were bound to fall by the amount of the protective duties after the introduction of free-trade-,which was also a tenet of the school. In addition to this, steamships and railways the workers, for the first time, freedom of movement. The raised wages in England, at the expense of rents, to the level s of labour earned by emigrants on rent- and American land (freeland farmers). At the same time the produce of these freeland farmers reduced the price of English farm produce-again at the expense of the English landlords. In Germany and France this natural development was intensified to such a degree by the adoption of the gold standard that a collapse would have occurred if the State had not countered the results of its first intervention (gold standard) by a second intervention (wheat-duties).

It is easy to understand, therefore, why the Manchester economists living in the midst of this precipitate development, and over-estimating its importance, believed that the free play of economic forces might be expected to cleanse the second plaguespot in our economic system, namely private ownership of rent on land.

In the third place the Manchester economists held that since the application of their principle, the free play of economic forces had eliminated local outbreaks of famine, the same methods, namely improvement of the means of communication, trade organisation, extension of banking facilities and so forth, must eliminate the causes of commercial crises. It had been proved that famines are the result of defective local distribution of foodstuffs, so commercial crises were supposed to be the result of defective distribution of goods. And, indeed, if we are conscious of how greatly the short-sighted policy of protective duties disturbs the natural economic development of nations and of the world, we can readily pardon the mistake of a free-trader of the Manchester school who, ignorant of the mighty disturbances which can be caused by defects of the traditional monetary system, expected the elimination of economic crises simply from free-trade.

The Manchester school argued further: “ If, by universal free-trade, we can keep economic life in full activity; if the result of such untrammelled, uninterrupted work is an over-production of capital which reduces and finally eliminates interest; if in addition, the effect of the free play of economic forces on rent is what we expect, the taxable capacity of the population must increase to such a degree that within a short time the whole of the national and local debts all over the world can be repaid. This will cleanse the fourth and last plague-spot in our economic life, the burden of public debt. The ideal of freedom upon which our system is based will then be justified before the whole world, and our envious, malevolent and often dishonest critics will be reduced to silence.”

That these fair hopes of the Manchester school have in no single particular been fulfilled, that, on the contrary, the defects of the existing economic order are becoming greater as time goes on, is due to the fact that the Manchester economists, through ignorance of monetary theory, adopted without criticism the traditional monetary system which simply breaks down when the development foretold by the Manchester economists sets in. They did not know that money makes interest the condition of its services, that commercial crises, the deficit in the budget of the earning classes and unemployment are simply effects of the traditional form of money. The Manchester ideals and the gold standard are incompatible.

In the Natural Economic Order, Free-Land and Free-Money win eliminate the unsightly, disturbing, dangerous concomitants of the Manchester system, and create the conditions necessary for a truly free play of economic forces. We shall then see whether such a social order is not superior to the creed at present in vogue which promises salvation from the assiduity, sense of duty, incorruptibility and humanitarian feelings of a horde of officials.

The choice lies between private control and State control of economic life; there is no third possibility. Those who refuse to make this choice may, to inspire confidence, invent for the order they propose attractive names such as co-operation or guild-socialism, or nationalisation, but the fact cannot be disguised that all these amount to the same thing, the same abominable rule of officials, the death of personal freedom, personal responsibility and independence.

The proposals made in this book bring us to the cross-roads. We are confronted with a new choice and must now make our decision. No people has hitherto had an opportunity of making this choice, but the facts now force us to take action, for economic life cannot continue to develop as it has hitherto developed. We must either repair the defects in the old economic structure or accept communism, community of property. There is no other possibility.

It is immensely important that the choice should be made with care. This is no question of detail such as, for example, whether autocratic government is preferable to government by the people, or whether the efficiency of labour is greater in a State enterprise than in a private enterprise. We are here on a higher plane. We are confronted with the problem, to whom is the further evolution of the human race to be entrusted? Shall nature, with iron logic, carry out the process by natural selection, or shall the feeble reason of man — present — day, degenerate man — take over this function from nature? That is what we have to decide.

In the Natural Economic Order, selection under free competition untrammelled by privileges will be determined by personal achievement, and will therefore result in the development of the qualities of the individual; for work is the only weapon of civilised man in the struggle for existence. Man seeks to hold his own in competition by constantly increasing and perfecting his achievements. These achievements determine whether and at what time he can found a family, in which manner he can rear his children and ensure the propagation of his qualities. Competition of this kind must not be pictured as a wrestling match or as a struggle such as takes place, for example, among the desert beasts of prey. Nor should it be imagined that the issue for the vanquished is death. Such a form of selection would be purposeless, for human strength is no longer brute force. We should have to go far back into human history to find a leader who owed his position to brute force. For the losers, therefore, competition has no longer the same cruel consequences as in those early days. They would merely, because of their inferiority, meet with greater obstacles when founding a family and bringing up their children, and as a result would have a smaller number of descendants. Even this result would not always follow in individual cases, for something would depend on chance. But beyond all doubt free competition would favour the efficient and lead to their increased propagation; and that alone would suffice to ensure the ascent of man.

Natural selection, thus restored, will be further intensified in the Natural Economic Order by the elimination of sex privileges. To secure this aim, rent upon land will be divided among the mothers in proportion to the number of their children, as compensation for the burden of rearing children (Swiss mothers, for example, will receive about 60 francs a month for each child). This should make women economically independent enough to prevent them from marrying out of economic necessity, or from prolonging a marriage repugnant to their feelings, or from being forced into the class of prostitutes after a first false step. In the Natural Economic Order women will have not alone freedom to choose their political representatives (an empty boon!) but freedom to choose their mates; and upon this freedom is based the whole selective activity of nature.

Natural selection in its full, miraculous effectiveness is then restored. The greater the effect of medical science upon the conservation and propagation of congenitally inferior individuals, the more important it becomes to preserve in full activity nature’s methods of natural selection. We can then without reproach yield to the humane and Christian feelings which urge the application of medical science. No matter how great the quantity of pathological material resulting from the propagation of defective individuals, natural selection can cope with it. Medical art can then delay, but it cannot arrest eugenesis.

If, on the other hand, we decide for State control of economic life, we exclude nature from the process of selection. Human propagation is not, indeed, formally handed over to the State, but virtually it passes under State control. The State determines whether and at what time a man can found a family, and what sort of upbringing he can provide for his children. By paying its officials different salaries the State at present intervenes decisively in the propagation of those in its service, and in the future this intervention would become general. The type of human being which pleased the State authorities would become the prevailing type. The individual would then no longer gain his position by personal capacity, by his relation to other men and to his surroundings; his success or failure would, on the contrary, depend upon his relation to the heads of the party in power. He would obtain his position by intrigue, and the cleverest intriguers would leave the largest number of descendants — endowed of course with the qualities of their parents. In this way State control of economic life would influence the breeding of men, as changes of fashion in clothing influence the breeding of sheep, and determine the numbers of white sheep and black sheep bred. The authority composed of the cleverest intriguers would appoint — promote or degrade — each individual. Those who refused to become intriguers would fall into the rear, their type would become less numerous and finally disappear. The State mould would form men. A development above the type it produced would be impossible.

I shall spare my readers a description of social life as it would develop under State control. But I should like to remind them that the principle of the free play of economic forces, even the travesty of this principle known to us before the war allows very great freedom to large sections of society. Greater independence than that enjoyed by the possessors of money cannot well be imagined. They have complete freedom of choice of profession, work as they think fit, live as they wish, have perfect freedom of movement and never learn the meaning of State control. No one asks them from where they receive their money. They travel round the world with no other luggage than an “ open Sesame “ in the shape of a cheque-book-truly, for those concerned, an ideal state of things. This is indeed recognised as the Golden Age — except by those excluded from this freedom by defects of construction in our otherwise fundamentally sound economic system — except, that is, by the proletariat. But are the wrongs of the proletariat, the defects of construction in our economic system, any reason for rejecting the system itself and introducing, in its stead, a new system bound to deprive all men of their freedom, and to plunge the whole world into slavery? Would it not be more reasonable to repair the faults of construction, to liberate the discontented workers, and in this way to make all men sharers in the priceless freedom of the present system? For the aim, most certainly, is not to make all men unhappy; it is, on the contrary, to give all men access to the sources of the joy of life, which can be unsealed only by free play of the forces inherent in man.

From the point of view of economic technique, that is of the efficiency of labour, the question of whether private enterprise is preferable to State enterprise is equivalent to the question whether, in general, the impulse of self-preservation is more effective in overcoming the difficulties connected with each man’s task in life than is the impulse of race-preservation.[1]

This question, because of its immediate practical importance, is perhaps more generally interesting than the process of natural selection which requires ages to take effect. We shall examine it briefly.

It is a curious phenomenon that a communist, an advocate of community of property, usually believes all other men-so far at least as they are personally unknown to him — to be more unselfish than himself. Thus it often happens that the most short-sighted egoists, who think first of themselves and sometimes only of themselves, are in theory enthusiastic communists. Anyone who wishes to convince himself of this fact need only, in an assembly of communists, make the truly communistic proposal of pooling and redistributing in equal shares wages and salaries. The result is a general silence, even among those who, a moment before, were loudest in their praises of community of goods. All are silent because all are calculating whether they would gain by community of wages. The leaders flatly reject the proposal with the flimsiest arguments. Yet in fact there is no obstacle to this community of income but the egoism of communists. Nothing prevents the workers in a factory, community, or trade-union from pooling their wages and distributing the total amount according to the needs of the separate families. By this plan they could gain experience in a matter of difficulty; they could convince the whole world of their communistic principles, and completely refute the sceptics who deny that man is a communist. No one prevents such communistic experiments; neither the State, nor the Church, nor the capitalists. No capital is required, no paid officials, no complicated preparations. A start could be made any day on any desired scale. But the need among communists for real community of economic life is apparently so small that such an experiment has never been attempted. Pooling of wages within the capitalistic system only requires that the proceeds of labour should be divided according to the personal needs of each individual; but for a State built upon community of property it would be further necessary to prove that this system did not diminish the individual’s joy of work. This also the communists could prove by pooling their wages. For if, after introduction of community of wages (that is after abolition of all special reward for special effort) effort (especially in piece-work) did not diminish; if the pooling of wages did not reduce the total earnings; if the most efficient communists put their larger earnings into the wage-fund as cheerfully as at present into their pockets, then the proof would be complete. The failure of the numerous communistic experiments in the sphere of production is by no means so conclusive a proof of the impossibility of communism as the simple fact that the proposal to pool wages always meets with point-blank rejection; for community in the production of goods requires special preparations, discipline, technical and commercial leadership and, as well, instruments of production. Failure can therefore be explained in many ways, and is not a conclusive proof that the principle itself is false, that the communistic spirit, the feeling of solidarity, is too weak. But the proposal to pool wages makes evasive arguments impossible. Its rejection is direct testimony against the communistic spirit against the assertion that the impulse of race-preservation is sufficiently strong to overcome the hardships attached the tasks of life.

It is no escape from the logic of these facts to point to the existence of communism among the early Christians. The early Christians who practised, it appears, community of earnings but not the more difficult community of production, acted upon religious principles; and the others who practised family or tribal communism were under the orders of a patriarch, a father of the community. Both acted under forced or fanatical obedience, not in obedience to impulse. They were driven by necessity; they had no choice. Again, the production of goods for exchange, the division of labour, which makes differences in the individual achievements measurable and visible to every eye, had not yet been established. Primitive men sowed and reaped, fished and hunted in company, they were all pulling on the same rope, so it was not noticeable whether an individual pulled a little more or less. No standards of measurement existed or were necessary, and life in common was tolerable. But with the production of goods for exchange, with the division of labour, a social order of this kind became impossible. The exact number of ells, pounds or bushels contributed by each member of the community was known to everyone and the peaceable division of the product of labour was a thing of the past. Everyone wished to dispose of the product of his own labour, above all the most efficient workers, those who could point to the greatest achievements and consequently enjoyed the respect of the community. The leaders must have endeavoured to dissolve the community, and they must have been supported by all whose achievements were above the average. When individual production became possible, community of production necessarily disappeared. Community of economic life, communism, did not disappear because it was feared and attacked by outside enemies. It succumbed to inner enemies “ consisting always, in this case, of the most efficient members of the community. If communism were based upon an impulse stronger than egoism, upon an impulse common to all men, it would have prevailed. The adherents of communism, no matter how often driven asunder by outward events, would always have tended to come together again.

The driving force of communism, the impulse of race-preservation (the feeling of solidarity, altruism), is, indeed, but a diluted solution of the impulse of self-preservation which makes for individualism in economic life, and its efficacy is therefore in inverse proportion to the amount of dilution. The larger the society (commune), the greater is the dilution, the weaker is the impulse to work for preservation of the community. An individual who works with one companion is less industrious than an individual who enjoys the fruit of his labour alone. If there are 10, 100, or 1000 companions, the impulse to work must be divided by 10, 100, or 1000; and, if the whole human race is to share in the proceeds of labour, everyone will say to himself: “ It does not matter how 1 work, for my work is but a drop in the ocean.” Work is then no longer impulse-driven; impulse must be replaced by some form of compulsion.

For this reason the Neuchâtel savant, Ch. Secrétan, is right in saying: “Egoism should be, in the main, the stimulus of work. Everything, therefore, that can give this impulse more force and freedom of action must be encouraged; everything that weakens and limits this impulse must be condemned. This fundamental principle must be applied with inflexible resolution despite the opposition of short-sighted philanthropy and the condemnation of the Churches.”

We are then justified in promising that even those who believe themselves indifferent to the higher aims of the Natural Economic Order will benefit from this reform. They may look forward to a better table, to better houses, to more beautiful gardens. The Natural Economic Order will be technically superior to the present, or to the communistic order.

PREFACE TO THE FOURTH EDITION, 1920

Thanks to active and widespread propaganda by the now numerous friends of the Natural Economic Order, this fourth edition follows, after a brief interval, the large third edition.

Of the contents of the book I can say that the war has shown me nothing new. I have not been obliged to revise even the smallest detail of my theory. The events of the war and of the German revolution are so many proofs of the correctness of what I wrote before the war; and that is true of both the theoretical contents and of the political application of these theories. The war has given capitalists, communists, Marxists, much food for reflection. Many. perhaps most, men admit that their programmes were faulty, or they are frankly perplexed and embarrassed. Most men indeed no longer even know to what party they belong. All this confirms the truth of the principles upon which the Natural Economic Order is based.

The political parties all lack an economic programme; they are held together by catchwords. Capitalism must be modified, that even capitalists admit. Bolshevism or communism may be possible in a primitive state of society, such as is still found in rural parts of Russia, but such prehistoric economic forms cannot be applied to a highly developed economic system founded on the division of labour. The European has outgrown the tutelage inseparable from communism. He must be free not alone from capitalistic exploitation, but also from meddling official intervention, which is an integral part of social life based on communism. For this reason we shall experience failure after failure in the present attempts at nationalising industry.

The communist, the advocate of the system of common property, stands at the extreme right wing, at the entrance-door of social development. Communism is therefore the most extreme form of reaction. The Natural Economic Order, on the contrary, is the programme of action, of progress, of the fugleman on the extreme left. Transitional stages, merely, lie between.

The transition from the half-developed human being of the horde to the independent, fully-developed individual, the “a-crat”, who rejects completely the control of others, begins with the division of labour. The transition would long ago have been completed if it had not again and again been interrupted by certain defects in our system of land tenure and in our form of money — defects which produced capitalism; and capitalism produced, for its own protection, the State as we know it — a hybrid between communism and the Natural Economic Order. We cannot at this stage of development; the difficulties created by the hybrid would in time ruin us as they ruined the peoples of antiquity. There is no question today of halting or retreating; the choice lies between progress or ruin; we must push on through the slough of capitalism to the firm ground beyond.

The Natural Economic Order is not a new order artificially put together. To allow the development of the order which starts from the division of labour, it was only necessary to remove the obstacles due to defects in our monetary system and our system of land tenure. More than this has not been attempted. The Natural Economic Order has nothing to do with Utopias and visionary enthusiasm. The Natural Economic Order stands by itself and requires no legal enactments, it makes officials, the State itself and all other tutelage superfluous, and it respects the laws of natural selection to which we owe our being; it gives every man the possibility of fully developing his ego. Its ideal is the ideal of the personality responsible for itself alone and liberated from the control of others-the ideal of Schiller, Stirner, Nietzsche and Landauer.

May 5th, 1920.

Silvio Gesell

PART I. DISTRIBUTION

INTRODUCTION

If employers of labour were offered money-capital at half the present rate of interest, the yield of every other class of capital would soon also fall to half. If, for example, interest on the money borrowed to build a house is less than the rent of a similar existing house, or if it is more profitable to bring a waste into cultivation than to rent similar farmland, competition must inevitably reduce house and farm rents to the level of the reduced interest on money. For the surest method of depreciating material capital (a house, a field) is obviously to create and operate additional material capital alongside it. But it is a law of economics that increased production increases the mass of available money-capital. This tends to raise wages and finally to reduce interest to zero.

Proudhon: What is Property?

The abolition of unearned income, of so-called surplus-value also termed interest and rent, is the immediate economic aim of every socialistic movement. The method generally proposed for the attainment of this aim is communism in the shape of nationalisation or socialisation of production. I know of only one socialist — Pierre Joseph Proudhon — whose investigations into the nature of capital point to the possibility of another solution of the problem. The demand for nationalisation of production is advocated on the plea that the nature of the means of production necessitates it. It is usually asserted off-hand, as a truism, that ownership of the means of production must necessarily in all circumstances give the capitalist the upper hand when bargaining with the workers about wages — an advantage represented, and destined eternally to be represented, by “ surplus-value” or capital-interest. No one, except Proudhon, was able to conceive that the preponderance now manifestly on the side of property can be shifted to the side of the dispossessed (the workers), simply by the construction of a new house beside every existing house, of a new factory beside every factory already established.

Proudhon showed socialists over fifty years ago that uninterrupted hard work is the only method of successfully attacking capital. But this truth is even further from their comprehension to-day than it was in Proudhon’s time.

Proudhon, indeed, has not been entirely forgotten, but he has never been properly understood. If his advice had been understood and acted on, there would now be no such thing as capital. Because he was mistaken in his method (the exchange banks), his theory as a whole was discredited.

How was it that the Marxian theory of capital succeeded in ousting that of Proudhon and in giving sovereign sway to cornmunistic socialism? How is it that Marx and his theory are spoken of by every newspaper in the world? Some have suggested as a reason the hopelessness, and the corresponding harmlessness, of the Marxian doctrine. “No capitalist is afraid of his theory, just as no capitalist is afraid of the Christian doctrine; it is therefore positively an advantage to capital to have Marx and Christ discussed as widely as possible, for Marx can never damage capital. But beware of Proudhon; better keep him out of sight and hearing! He is a dangerous fellow since there is no denying the truth of his contention that if the workers were allowed to remain at work without hindrance, disturbance or interruption, capital would soon be choked by an over-supply of capital (not to be confused with an over-production of goods). Proudhon’s suggestion for attacking capital is a dangerous one, since it can be put into practice forth-with. The Marxian programme speaks of the tremendous productive capacity of the present-day trained worker equipped with modem machinery and tools, but Marx cannot put this tremendous productive capacity to use, whereas in the hands of Proudhon it becomes a deadly weapon against capital. Therefore talk away, harp on Marx, so that Proudhon may be forgotten.”

This explanation is plausible. And is not the same true of Henry George’s land-reform movement? The landowners soon discovered that this was a sheep in wolf’s clothing; that the taxation of rent on land could not be carried out in an effective form and that the man and his reform were therefore harmless. The Press was allowed to advertise Henry George’s Utopia, and land-reformers were everywhere received in the best society. Every German “agrarian” and speculator in corn-duties turned single-taxer. The lion was toothless, so it was safe to play with him, just as many persons of fashion are pleased to play with Christian principles.

Marx’s examination of capital goes astray at the outset.

Marx succumbs to a popular fallacy and holds that capital consists of material goods. For Proudhon, on the contrary, interest is not the product of material goods, but of an economic situation, a condition of the market.

Marx regards surplus-value as spoil resulting from the abuse of a power conferred by ownership. For Proudhon surplus-value is subject to the law of demand and supply.

According to Marx, surplus-value must invariably be positive. For Proudhon the possibility of negative surplus-value must be taken into consideration. (Positive surplus-value is surplus-value on the side of supply, that is, of the capitalist, negative surplus-value is surplus-value on the side of labour).

Marx’s remedy is the political supremacy of the dispossessed, to be achieved by means of organisation. Proudhon’s remedy is the removal of the obstacles preventing us from the full development of our productive capacity.

For Marx, strikes and crises are welcome occurrences, and the final forcible expropriation of the expropriators is the means to the end. Proudhon, on the contrary, says: On no account allow yourselves to be deterred from work, for the most powerful allies of capital are strikes, crises and unemployment; whereas nothing is more fatal to it than hard work.

Marx says: Strikes and crises will sweep you along towards your goal; the great collapse will land you in paradise. — No, says Proudhon, that is humbug, methods of that kind carry you away from your goal. With such tactics you will never filch as much as one per cent from interest.

To Marx private ownership means power and supremacy. Proudhon, on the contrary, recognises that this supremacy is rooted in money, and that under altered conditions the power of private ownership may be transformed into weakness.

If, as Marx affirms, capital consists of material goods, possession of which gives the capitalist his supremacy, any addition to these goods would necessarily strengthen capital. If a load of hay or a barrowful of economic literature weighs 100 lbs., two loads, two barrowfuls must weigh exactly 200 lbs. Similarly if a house yields $1000 of surplus-value annually, ten houses added to it must always, and as a matter of course, yield ten times $1000 — on the assumption that capital consists simply of material goods.

Now we all know that capital cannot be added up like material goods, since additional capital not infrequently diminishes the value of capital already existing. The truth of this can be tested by daily observation. Under certain circumstances the price of a ton of fish may be greater than the price of 100 tons. What price would air fetch, if it were not so plentiful? As it is, we get it gratis.

Not long before the outbreak of the war landlords in the suburbs of Berlin were in despair about the decline of house-rents, that is, surplus-value, and the capitalistic press was clamorous in denunciation of the

“building fury of the workers and contractors”,

of the

“building plague rife in the housing industry.”

(Quoted from the German Press.)

Are not these expressions a revelation of the precarious nature of capital? Capital, which Marxists hold in such awe, dies of the “building plague”; it decamps before the “building fury” of the workers! What would Proudhon and Marx have advised in such a situation? “Stop building”, Marx would have cried; “lament, go abegging, bemoan your unemployment, declare a strike! For every house you build adds to the power of the capitalists as sure as two and two make four. The power of capital is measured by surplus-value, in this case house-rent; so the greater the number of houses the more powerful, surely, is capital. Therefore let me advise you, limit your output, agitate for an eight-hour or even a six-hour day, since every house you build adds to house-rent and house-rent is surplus-value. Restrain, therefore, your building fury, for the less you build, the more cheaply you’ll be housed!”

Probably Marx would have shrunk from uttering such nonsense. But the Marxian doctrine, which regards capital as a material commodity, misleads the workers into thinking and acting on these lines.

Now listen to Proudhon: “Full steam ahead! Let’s have the building fury, give us the building plague! Workers and employers, on no account let the trowel be snatched from your hands. Down with all who attempt to interfere with your work; they are your deadly enemies! Who are these that prate of a building plague, of over-production in the housing industry, while house-rents still show a trace of surplus-value, of capital-interest? Let capital die of the building plague! For some five years only have you been allowed to indulge in your building fury, and already capitalists feel the pinch, already they are lamenting the decline of surplus-value, rents have already dropped from 4 to 3 % — that is, by a quarter. Three times five years more of untrammelled labour, and you will be revelling in houses freed from surplus-value. Capital is dying, and it is you who are killing it by your labour.”

Truth is as sluggish as a crocodile in the mud of the eternal Nile. It does not reck of time; time measured by the span of human life means nothing to it, since it is everlasting. But truth has an agent which, mortal like man, is always hurried. For this agent, time is money; it is ever busy and excited, and its name is error. Error cannot afford to lie low and let the ages pass. It is constantly giving and receiving hard knocks. It is in the way of everyone and everyone is in its way. It is the true stumbling block.

Therefore it does not matter if Proudhon is taboo. His adversary Marx, with his errors, takes good care that the truth shall come to light. And in this sense we may say that Marx has become the agent of Proudhon. Proudhon in his grave is at peace. His words have everlasting worth. But Marx must keep restlessly moving. Some day, however, the truth will prevail and Marx’s doctrines will be relegated to the museum of human errors.

Even if Proudhon had really been suppressed and forgotten, the nature of capital would still remain unchanged. The truth would be discovered by another; of the discoverer’s name truth takes no account.

The author of this book was led into the path pursued by Proudhon and came to the same conclusions. Perhaps it was fortunate that he was ignorant of Proudhon’s theory of capital, for he was thus enabled to set about his work the more independently, and independence is the best preparation for scientific inquiry.

The present author has been more fortunate than Proudhon. He discovered what Proudhon had discovered fifty years earlier, namely the nature of capital, but as well he discovered a practicable road to Proudhon’s goal. And that, after all, is what matters.

Proudhon asked: Why are we short of houses, machinery and ships? And he also gave the correct answer: Because money limits the building of them. Or, to use his own words: “Because money is a sentinel posted at the entrance to the markets, with orders to let no one pass. Money, you imagine, is the key that opens the gates of the market (by which term is meant the exchange of products), that is not true-money is the bolt that bars them.”

Money simply will not suffer another house to be built in addition to every existing house. As soon as capital ceases to yield the traditional interest, money strikes and brings work to a standstill. Money, therefore, acts like a serum against the “building-plague” and the “working fury”. It renders capital (houses, industrial plant, ships) immune from the menace of its own increase.

Having discovered the barring or blocking nature of money, Proudhon raised the slogan: Let us combat the privilege of money by raising goods and labour to the level of money. For two privileges, if opposed, neutralise one another. By attaching to goods the surplus weight now on the side of money, we make the two weights balance.

Such was Proudhon’s idea, and to put it into practice he founded the exchange banks. As everyone knows, they failed.

And yet the solution of the problem which eluded Proudhon is simple enough. All that is needed is to abandon the customary standpoint, the standpoint of the possessor of money, and to look at the problem from the standpoint of labour and of the possessor of goods. This shifting of the standpoint will let us grasp the solution directly. Goods, not money, are the real foundation of economic life. Goods and their compounds make up 99% of our wealth, money only 1%. Therefore let us treat goods as we treat foundations; let us not tamper with them. We must accept goods as they appear in the market. We cannot alter them. If they rot, break, perish, let them do so; it is their nature. However efficiently we may organise Proudhon’s exchange banks, we cannot save the newspaper in the hands of the newsvendor from being reduced, two hours later, to waste paper, if it fails to find a purchaser. Moreover we must remember that money is a universal medium of saving; all the money that serves commerce as a medium of exchange comes to the savings banks and lies there until it is enticed into circulation again by interest. And how can we ever raise goods to the level of ready money (gold) in the eyes of savers? How can we induce them, instead of saving money, to fill their chests or store-rooms with straw, books, bacon, oil, hides, guano, dynamite, porcelain?

And yet this is what Proudhon really aimed at in attempting to bring goods and money to a common level. Proudhon had overlooked the fact that money is not only a medium of exchange, but also a medium of saving, and that money and potatoes, money and lime, money and cloth can never in any circumstances be looked upon as things of equal worth in the chests of the savers. A youth saving against old age will prefer a single gold coin to the contents of the largest warehouse.

We cannot, therefore, tamper with goods, they are the primary factor to which everything else must be adapted. But let us look a little more closely at money, for here some alteration may prove feasible. Must money always remain what it is at present? Must money, as a commodity, be superior to the commodities which, as medium of exchange, it is meant to serve? In case of fire, flood, crisis, war, changes of fashion and so forth, is money alone to be immune from damage? Why must money be superior to the goods which it is to serve? And is not the superiority of money to goods the privilege which we found to be the cause of surplus-value, the privilege which Proudhon endeavoured to abolish? Let us, then, make an end of the privileges of money. Nobody, not even savers, speculators, or capitalists, must find money, as a commodity, preferable to the contents of the markets, shops, and warehouses. If money is not to hold sway over goods, it must deteriorate, as they do. Let it be attacked by moth and rust, let it sicken, let it run away; and when it comes to die let its possessor pay to have the carcass flayed and buried. Then, and not till then, shall we be able to say that money and goods are on an equal footing and perfect equivalents — as Proudhon aimed at making them.

Let us put this demand in terms of a commercial formula. We say: The possessor of goods, during the period of storage, invariably incurs a loss in quantity and quality. Moreover he has to pay the cost of storage (rent, insurance, caretaking and so on). What does all this amount to annually? Say 5% — which is more likely to be below than above the actual amount.

Now what depreciation has a banker, capitalist, or hoarder to debit to the money in his possession or on loan? By how much was the war-chest in the Julius Tower at Spandau diminished in the course of the 44 years that it was stored there? Not by one penny!

That being so, the answer to our question is clear, we must subject money to the loss to which goods are liable through the necessity of storage. Money is then no longer superior to goods; it makes no difference to anyone whether he possesses, or saves, money or goods. Money and goods are then perfect equivalents, Proudhon’s problem is solved and the fetters that have prevented humanity from developing its full powers fall away.

1. AIM AND METHOD

As has been pointed out in the Introduction, the economic aim of every kind of socialism is to abolish unearned income, so-called surplus-value, sometimes termed rent and interest. To attain this end, nationalisation or socialisation of production with all its consequences is usually declared to be indispensable.

This claim of the dispossessed is supported by Karl Marx’s scientific investigation into the nature of capital which attempts to prove that surplus-value is an inseparable concomitant of private enterprise and private ownership of the means of production.

The present writer proposes to demonstrate that this Marxian doctrine is based on untenable premises which we must abandon in order to arrive at the truth. My conclusions are to the effect that capital must not be looked upon as a material commodity, but as a condition of the market, determined solely by demand and supply. The French socialist Proudhon, the opponent of Marx, gave the workers the proof of this more than 50 years ago.

Guided by this corrected theory of capital we shall learn that the removal of certain artificial obstacles due to private ownership of land and our irrational monetary system, will enable our present economic order to realise fully its fundamentally sound principle. The removal of these obstacles will allow the workers by their own labour and in a short time (ten to twenty years) so to alter the market conditions for capital that surplus-value will disappear completely and the means of production will lose their capitalistic character. Private ownership of the means of production will then present no advantage beyond that which the owner of a savings-box derives from its possession: the savings-box does not yield him surplus-value or interest, but he can gradually use up its contents.

The savings or other money then invested in means of production (house, ship, factory) will be returned to the owners in the shape of sums annually written off their value in proportion to their natural wear and tear or consumption. Simply by means of untrammelled hard work fructified by the powerful modern instruments of production, the great admired and dreaded tyrant capital will be reduced to the harmless role of a child’s porcelain savings-box. The savings-box yields no surplus-value, and to get at the contents its owner must break it.

The first and second parts of this book, dealing with land, show how agriculture and the building and mining industries can be carried on without surplus-value, yet without communism. The later parts of the book, dealing with the new theory of capital, show how, without nationalising the remaining means of production, we can entirely eliminate surplus-value from our economic order and establish the right to the whole proceeds of labour.

2. THE RIGHT TO THE WHOLE PROCEEDS OF LABOUR

A worker in this book means anyone living on the proceeds of his labour. By this definition farmers, employers, artisans, wage-earners, artists, priests, soldiers, officials, kings, are workers. The antithesis of a worker in our economic system is therefore the capitalist, the person in receipt of unearned income.

We distinguish between the product of labour, the yield of labour and the proceeds of labour. The product of labour is what is produced by labour. The yield of labour is the money received through the sale of the product of labour or as the result of the wage contract. The proceeds of labour mean what a worker, out of the yield of his labour, can buy and convey to the place of consumption.

The terms: wages, fee, salary are used instead of the term yield of labour when the product of labour is not a tangible object. Example: street-sweeping, writing poems, governing. If the product of labour is a tangible object, say a chair, and at the same time the property of the worker, the yield of labour is not called a wage or salary, but the price of the object sold. All these designations imply the same thing: the money-yield of the work done.

Manufacturers’ and merchants’ profits, after deduction of the capital interest or rent usually contained in them, are likewise to be classed as yield of labour. The manager of a mining company draws his salary exclusively for the work done by him. If the manager is also a shareholder, his income will be increased by the amount of the dividend received. He is then at once a worker and a capitalist. As a rule the income of farmers, merchants and employers is made up of the yield of their labour plus a certain quantity of rent or interest. A farmer working on rented land with borrowed capital lives exclusively on the proceeds of his labour. What is left to him of the product of his labour after payment of rent and interest, is the result of his activity and is subject to the general laws determining wages.

Between the product of labour (or service rendered) and the proceeds of labour lie the various bargains which we strike daily in buying the commodities we consume. These bargains greatly affect the proceeds of labour. It very commonly happens that two persons offering the same product of labour for sale obtain unequal proceeds of labour. The reason for this is that though equal as workers, they are unequal as dealers. Some persons excel at disposing of their product for a good price, and at making judicious choice when purchasing the commodities they need. In the case of goods produced for the market, the commercial disposal of them and the knowledge necessary for successful bargaining contribute as much to the success of labour as does technical efficiency. The exchange of the product must be considered as the final act of production. In so far every worker is also a dealer.

If the objects composing the product of labour and those composing the proceeds of labour had a common property by which they could be compared and measured, commerce, that is, the conversion of the product of labour into the proceeds of labour. might be dispensed with. Provided the measuring, counting or weighing were accurate, the proceeds of labour would always be equal to the product of labour (less interest and rent), and the proof that no sort of cheating had taken place could be supplied by examination of the objects of the proceeds of labour, just as one may asceration by one’s own scales whether the druggist’s scales weigh correctly or not. Commodities have however no such common property. The exchange is always effected by bargaining, never by the use of any kind of measure. Nor does the use of money exempt us from the necessity of bargaining to effect the exchange. The term “measure of value” sometimes applied to money in antiquated writings on economics, is misleading. No quality of a canary bird, a pill or an apple can be measured by a piece of money.

Hence a direct comparison between the product of labour and proceeds of labour will not furnish any valid and legal proof as to whether the labourer has received the whole proceeds of his labour. The right to the whole proceeds of labour, if by that phrase we mean the individual’s right to the whole proceeds of his labour, must be relegated to the realm of imagination.

But it is very different with the common or collective right to the whole proceeds of labour. This only implies that the proceeds of labour should be divided exclusively among the workers. No proceeds of labour must be surrendered to the capitalist as interest or rent. This is the only condition imposed by the demand for the right to the common or collective whole proceeds of labour.

The right to the collective whole proceeds of labour does not imply that we should trouble about the proceeds of labour of the individual worker. For whatever one worker may fail to secure will be added to the remuneration of another worker. The apportioning of the workers’ shares follows, as hitherto, the laws of competition, competition being keener, and the personal proceeds of labour being less, the easier and simpler the work. The workers who perform the most highly qualified work are most securely withdrawn from the competition of the masses, and are therefore able to obtain the highest price for the product of their labour. In certain cases some natural physical aptitude (such as singing, for example) may take the place of intelligence in eliminating the competition of the masses. Fortunate is he whose service liberates him from the dread of competition.

The realisation of the right to the whole proceeds of labour will benefit all individual workers in the form of an addition to the present proceeds of their labour, which may be doubled or trebled, but will not be levelled. Levelling the proceeds of labour is an aim of communism. Our aim, on the contrary, is the right to the whole proceeds of labour as apportioned by competition. As an accompanying effect of the reforms necessary to ensure the right to the whole common proceeds of labour, we may, indeed, expect the existing differences in the individual proceeds of labour which are sometimes, particularly in commerce, very great, to be reduced to more reasonable proportions; but that is only an accompanying effect. The right to the whole proceeds of labour, in our sense, does not imply any such levelling. Industrious, capable and efficient workers will, therefore, always secure larger proceeds of labour, proportionate to their higher efficiency. To this will be added the rise of wages in consequence of the disappearance of unearned income.

Summary

-

The product of labour, the yield of labour and the proceeds labour are not immediately comparable. There is no common measure for these quantities. The conversion of one into the other is not done by measuring but by contract, by a bargain.

-

It is impossible to say whether the proceeds of labour of in workers do or do not correspond to the whole proceeds of their labour.

-

The whole proceeds of labour can only be understood to the common or collective proceeds of labour.

-

The right to the whole collective proceeds of labour implies the total abolition of all unearned income, namely interest and rent.

-

When interest and rent are eliminated from economic life, proof is complete, that the right to the whole proceeds of labour has been realised, and that the collective proceeds of labour are equal to the collective product of labour.

-

The suppression of unearned income raises the individual of labour — doubling or trebling them. There is no levelling to be expected, or only a partial one. Differences in the individual product of labour will be accurately translated into the individual proceeds of labour.

-

The general laws of competition determining the relative amounts of the individual proceeds of labour will remain in force. The most efficient worker will receive the highest proceeds of labour, to use as he pleases.

Today the proceeds of labour are curtailed by rent and interest, which are not, of course, determined arbitrarily, but by the conditions of the market, everyone taking as much as the conditions of the market allow him.

We shall now examine the manner in which these market conditions are created, beginning with rent on land.

3. REDUCTION OF THE PROCEEDS OF LABOUR THROUGH RENT ON LAND

A landowner has the choice of cultivating his land or allowing it to lie fallow. His possession of the land is independent of its cultivation. Land does not suffer from lying fallow; on the contrary, it improves; indeed, under certain systems of cultivation, to let the soil lie fallow is the only method of restoring its fertility.

A landowner, therefore, has no inducement to allow others to use his property (farm, building-site, oil or coal field, water-power, forest and so forth) without compensation. If the landowner is offered no compensation, no rent, for its use, he simply lets his land lie fallow. He is absolute master of his property.

Anyone needing land and applying to a landowner will obviously, therefore, have to make a disbursement called rent. Even if we could multiply the surface of the earth and its fertility, it would never occur to a landowner to let others use his land free of charge. If the worst came to the worst he might turn his property into a hunting ground or use it as a park. Rent is an inevitable condition of every tenancy, because the pressure of competition in the supply of land for letting can never be great enough to make the use of land gratuitous.

How much, then, will the landowner be able to demand? If the whole surface of the earth were needed for the sustenance of mankind; if no more free land were obtainable far or near; if the whole surface of the earth were in private possession and under cultivation, and if the employment of more labour, the application of so-called intensive cultivation, resulted in no increase of produce; then the dependence of those without property on their landlords would be as absolute as it was at the time of serfdom, and accordingly the landlords would raise their claims to the utmost limit of the attainable; they would claim for themselves the entire produce of labour, the entire harvest, and grant to the labourer, as to a common slave, only what sufficed for his subsistence and propagation. Under such conditions the so-called “ iron law of wages “ would hold good. Cultivators of the soil would be at the mercy of landowners, and rent would be equal to the yield of the land, less the cost of feeding the cultivator and his draught animals, and less capital-interest.

The conditions which would result in an “iron wage” do not, however, exist; for the earth is much larger and more fertile than is necessary for the support of its present population. Even with present-day extensive cultivation, hardly one-third of its area is exploited, the remainder lying fallow or being unclaimed. If instead of extensive cultivation, intensive cultivation were generally introduced — one-tenth of the surface of the earth would perhaps suffice to provide mankind with the average amount of foodstuffs consumed by the workers at the present day. Nine-tenths of the earth’s surface in this case, be left fallow. (Which, of course, does not mean that mankind would be satisfied with such a result. If everyone desired to eat his fill of something better than potatoes; if everyone wanted to have a saddle-horse, a court-yard with peacocks and pigeons, or a rose garden and a swimming-pool the earth might, even with intensive cultivation, be too small).

Intensive cultivation comprises: drainage of swamps, irrigation, mixture of soils, deep ploughing, blasting of rocks, marling, application of fertilisers; choice of plants for culture, improvements of plants and animals; destruction of pests in orchards and vineyards, destruction of locusts; saving of draught animals through railway, canal and motor transport; more economical use of foodstuffs and fodder through exchange; limitation of sheep-breeding through the cultivation of cotton; vegetarianism and so forth. Intensive cultivation requires much labour, extensive cultivation much land.

No one, then, is at present compelled, by complete lack of land, to appeal to the landowners, and because this compulsion does not exist (but solely for this reason) the dependence of those without land on the landowners is limited. But the landowners are in possession of the best land, and it would require a great deal of labour to bring into cultivation the only unclaimed land in settled neighbourhoods. Intensive cultivation, again, involves considerably more trouble, and not everyone is capable of emigrating and settling in the unclaimed lands of the wilderness; apart from the fact that emigration costs money, and that the produce of those lands can be brought to market only at great expense in transport-costs and import-duties.

The farmer knows all this, and the landowner likewise. So before the farmer makes up his mind to emigrate; before he sets about draining the neighbouring swamp; before he turns to market gardening, he will ask the landowner what rent he demands for his field. And before answering the question the landowner will think the matter over and calculate the difference between the proceeds of labour on his field and the proceeds of labour[2] on waste land, garden land, or unclaimed land in Africa, America, Asia, or Australia. For the landowner is determined to obtain this difference for himself; this is what he can claim as for his field. As a general rule, however, there is not much calculation. In these matters both parties are guided by experience. Some hardy young fellow emigrates and, if he reports favourably, others follow. In this way the supply of labour at home is reduced, the consequence being a general rise of wages. If emigration continues, wages will rise to a point at which the would-be emigrant becomes doubtful whether he had not better stay at home. This indicates that the proceeds of labour at home and in the new country are again equal. Sometimes an emigrant makes an estimate beforehand. So it may be worth while examining such a calculation.

| Travelling expenses for himself and family | $1000 |

| Accident and life insurance during the voyage | $200 |

| Health insurance for acclimatisation, that is, the slim which an insurance company would charge for the special risk due to the change of climate | $200 |

| Prospecting and fencing | $600 |

| We may assume that the same amount of working capital is required as in Germany, so it is not included in the estimate | |

| Cost of emigrating and settling | $2000 |

| These expenses, which the farmer in Germany does not incur, are added to the working capital. the interest on which is charged to working costs: 5% on $2000 | $100 |

|

We assume that the settler, with the same amount of the same amount as on his native competition of which is here to be considered. We remember that the farmer, like any other producer, in the products of his labour but only in the goods for consumption which he can obtain for that is, in the proceeds of his labour. The settler must send his products to market and convert the money he obtains for them into the goods he needs for consumption. And he must pay for the conveyance of these goods to his new home. The market for the exchange of his products is, as a rule, distant; if we suppose it to be Germany, a country which is forced to import large quantities of agricultural produce, the emigrant will have to pay: |

|

| Freight-charges for cart, railway, ship and lighter | $200 |

| Import-duty in Germany | $400 |

| Freight-charges for fighter, ship, railway and cart for the goods received in exchange | $200 |

| Import-duty in the new country | $100 |

| $1000 |

In the above estimate the conversion of the product of labour into the proceeds of labour, usually effected by way of commerce, the emigrant for freight, customs-duties and commercial profit the sum of $1000, an expense which the cultivator of German soil avoids. If, therefore, the latter pays $1000 in rent for a piece of land which yields the same product of labour as the emigrant’s homestead, the proceeds of his labour are equal to those of the emigrant.

There is the same economic difference in favour of the above piece of land when compared with waste land brought under cultivation in Germany, but here instead of transport costs and customs-duties, we have to enter the interest on the capital employed for reclaiming the land (drainage of a swamp, mixture of the different layers of soil, liming and manuring). In the case of intensive cultivation the difference consists, not of interest and freight, but of the cost of cultivation.

Rent, then, tends to reduce the proceeds (not the produce) of labour to the same general level everywhere. Whatever agricultural advantages well-cultivated German farm land possesses over the Luneburg Heath or, through its proximity to the markets, over unappropriated land in Canada, are claimed by landlords as rent, or appear, if the land is sold, as its price, which is simply the rent capitalised. All differences in land as regards fertility, climate, access to the markets, customs-duties, freights and so forth are levelled by rent. (It should be noted that in this connection wages are not mentioned; the omission is intentional).

Economically speaking, rent on land reduces the globe for the farmer, manufacturer and capitalist (if he is not a landowner), to a perfectly uniform surface. As Flürscheim puts it: “Just as the inequalities of the ocean bed are transformed into a level surface by the water, so inequalities of land are levelled by rent”. It is a remarkable fact that rent reduces the proceeds of labour of all cultivators of the soil to the yield which may be expected from unreclaimed land at home, or from unclaimed land in the far-off wilderness. The notions of fertile, barren, loamy, sandy, swampy, rich, poor, well or badly situated, are rendered, economically speaking, meaningless by rent on land. Rent makes it a matter of indifference to a man whether he cultivates moorland in the Eiffel, or a market-garden at Berlin, or a vineyard on the Rhine.

4. INFLUENCE OF TRANSPORT COSTS ON RENT AND WAGES

The proceeds of labour on freeland, waste-land, marsh and moor determine how much the landowner must pay as wages or how much he can claim as rent. The farm-labourer will obviously claim a wage equal to the proceeds of labour on freeland, since he is free to take possession of and cultivate freeland (which term we shall soon define more closely). Nor is it necessary for every farm-labourer to threaten to emigrate when negotiating about his wages. Married men with many children, for instance, would gain nothing by such a threat, since the landowner knows that it cannot be carried into effect. But it suffices if the emigration of the younger men causes a general shortage of labour. Even although many labourers are unable to emigrate, the shortage of labour caused by the emigration of others supports them in their negotiations about wages as effectively as if they had already booked their passage.[3]

On the other hand the tenant farmer must be allowed to keep for himself an amount equal to the proceeds of labour of the freeland emigrant and the farm-labourer, after deduction of farm-rent and the interest on his working capital. Thus farm-rent also, is determined by the proceeds of labour on freeland. The landowner when calculating the rent of a farm need not leave the tenant a margin greater than the proceeds of labour on freeland, and the tenant is not compelled to accept less.

If the proceeds of labour on freeland fluctuate, the fluctuation is transferred to wages and to farm-rent.

Among the circumstances influencing the proceeds of labour on freeland we must consider, in the first place, the distance between the unappropriated land and the place where the products are consumed. We may suppose this to be the place where the commodities taken in exchange are made (manufacturing centre) or collected (trading centre). The importance of the distance from the market is best seen from the difference in the price of a field in the vicinity of the town and an equally fertile field farther from the market. The reason for the difference in price is simply the distance from the market.

In the Canadian wheat district, for example, where to this day good land can be obtained free by everyone, the wheat has to be carried on wagons, along unbeaten tracks, to the far-distant railroad by which it is conveyed to Duluth to be shipped on lake steamers. These carry the wheat to Montreal, where it is transferred to ocean steamers. From there the voyage continues to Europe, say to Rotterdam, where another transfer to the Rhine vessels is necessary. These go as far as Mannheim, and to reach the markets of Strasbourg, Stuttgart or Zürich, the wheat must here be loaded on railway trucks. And its price in these markets, after payment of import-duties, must be the same as the price of wheat grown on the spot. It is a long journey costing a great deal of money; yet the balance of the market price that remains after deducting import-duties, freight, insurance, brokerage, stamp-duties, interest on money advanced, sacks, etc. is still only the sum obtained by the sale of the product of labour, and not what is required by the settler in the wilderness of Saskatchewan. This sum has to be transformed into articles for use — salt, sugar, cloth, fire-arms, tools, books, coffee, furniture, etc. and it is only when all these objects have arrived at the settler’s homestead, and the freight on them has been paid, that he can say: “These are the proceeds of my labour plus interest on my capital.” (Whether the settler has borrowed the money necessary for emigration or is working with his own capital, he is bound to deduct interest on his capital from the product of his labour).

It is obvious, therefore, that the proceeds of labour on such freeland must depend to a great extent on transport costs. These costs have been steadily sinking, as is shown by the following table: (Taken from Mulhall’s Dictionary of Statistics).

Freight-rates for one ton of grain from Chicago to Liverpool:-

| 1873 | $17 |

| 1880 | $10 |

| 1884 | $6 |